Key Points:

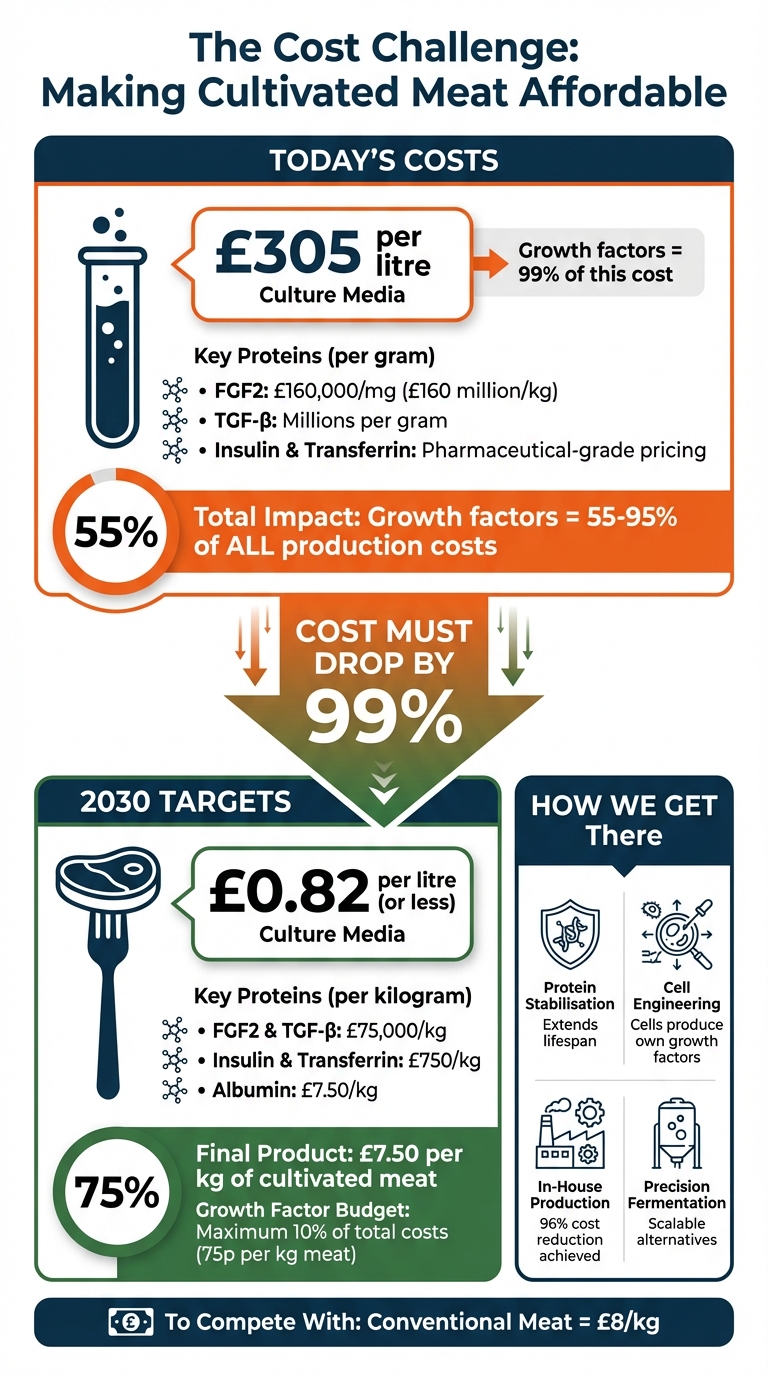

- Current Costs: Proteins like FGF2 and TGF‑β can cost millions per gram, with cell culture media costing up to £305 per litre.

- Target Costs: To compete with conventional meat (£8/kg), growth factors need to cost £82,000/kg or less, and media costs must fall below £0.82 per litre.

-

Solutions in Progress:

- Protein stabilisation: Extends the lifespan of growth factors, reducing usage.

- Cell engineering: Cells that produce their own growth factors eliminate external supplementation.

- In-house production: Cuts costs by up to 96% compared to buying from suppliers.

- Precision fermentation & plant-based alternatives: Offer cheaper, scalable options.

The industry aims to scale by 2030, but challenges remain in reducing costs, scaling production, and meeting demand for recombinant proteins. Achieving these goals is critical to making cultivated meat viable for everyday consumers.

Current vs Target Costs for Cultivated Meat Production

Why Growth Factors Are So Expensive

What Growth Factors Do

Growth factors play a crucial role in cultivated meat production by binding to cell receptors and triggering essential cell functions. They help cells migrate, multiply, and develop into tissues like muscle and fat [5]. However, these molecules come with a challenge: they are inherently unstable, with short lifespans ranging from just minutes to a few days. This instability means they need to be constantly replenished in the nutrient medium, which significantly drives up production costs [2]. This biological requirement creates a major financial hurdle for the industry.

The Scale of the Cost Problem

The cost of growth factors and recombinant proteins is staggering, accounting for 55–95% of overall production expenses [2]. When it comes to the culture medium specifically, growth factors alone can make up as much as 99% of the cost. Proteins like TGF‑β are particularly expensive and are among the main cost drivers [1]. For instance, in September 2022, ORF Genetics priced bovine, porcine, and avian FGF2 at approximately £160 per milligram [1]. Historically, pharmaceutical-grade proteins like TGF‑β and FGF2 have been priced in the millions per gram. However, for cultivated meat to be commercially viable, the industry needs these costs to plummet to roughly £82,000 per kilogram, or about £82 per gram [2][3].

"The combined cost of recombinant GFs and SPs must remain below 10% of the total cost per kilogram of meat to ensure commercial viability." – Good Food Institute [5]

The price gap between current costs and industry targets is massive. For cultivated meat to compete with traditional meat, which costs around £8 per kilogram, the culture medium must cost no more than £0.82 per litre [5]. Yet, some formulations currently cost upwards of £305 per litre, with 99% of that expense driven by just four proteins: FGF2, TGF‑β, insulin, and transferrin [1]. To bridge this gap, the industry must rethink how these proteins are produced and utilised.

Solutions to Lower Growth Factor Costs

Using Growth Factors More Efficiently

Rather than simply increasing dosages, manufacturers are finding smarter ways to make growth factors work harder and last longer. One effective method is protein stabilisation. By tweaking the amino acid sequences of growth factors like FGF2 and IGF1, scientists have developed "thermostable" versions that remain active for longer periods in the culture medium. These stabilised proteins require less frequent replacement, which translates to significant cost savings.

Another clever strategy involves targeted delivery systems. By embedding growth factors directly into scaffolds or microcarriers, they can be released gradually and stay in close proximity to the cells they’re meant to nourish. This targeted approach ensures more efficient use of growth factors, reducing the overall quantity needed.

Autocrine signalling - a process where cells are engineered to produce their own growth factors - offers a completely different solution. In January 2024, a research team at Tufts University, led by Professor David Kaplan, successfully engineered immortalised bovine satellite cells to internally express FGF2. These cells grew effectively in media without any FGF2 supplementation, achieving doubling times of about 60–80 hours. Kaplan highlighted the potential savings:

"Eliminating rFGF from the culture media would reduce production costs at scale by an order of magnitude in some cases" [7].

While these methods focus on using growth factors more efficiently, there are also efforts to overhaul how they’re produced.

Alternative Production Methods

Many manufacturers are now taking growth factor production into their own hands. Producing growth factors in-house has proven to be a game-changer, slashing costs dramatically. For example, in-house production of TGF‑β and FGF2 has brought costs down to just £0.66 per litre - only 4% of total media expenses compared to the staggering 95% incurred when sourcing from commercial suppliers [1]. Currently, around 40% of cultivated meat manufacturers are already producing their own growth factors [4].

Precision fermentation is another promising avenue. Canadian company Future Fields has pioneered the use of transgenic fruit flies (Drosophila melanogaster) to produce FGF2 and transferrin at scale [2]. Meanwhile, some manufacturers are exploring plant-based alternatives. For example, Future Meat replaced recombinant albumin with a chickpea-derived equivalent, cutting total media costs by an impressive 60% [4].

These innovative approaches are helping to make growth factor production more cost-effective, paving the way for broader applications in cultivated meat production.

Cost Targets and Timelines

Price Targets for Commercial Viability

As cultivated meat inches closer to becoming a mainstream option, hitting specific price goals is essential to compete with traditional meat products. To make this happen, the cost of producing cultivated meat must align with conventional options. A key benchmark is achieving a finished product cost of approximately £7.50 per kilogram. For this to work, growth factors and recombinant proteins - critical components in production - should contribute no more than 10% of total production costs, roughly 75 pence per kilogram of meat [3].

Each protein used in the process has its own target price. For instance, FGF2 and TGFβ need to be reduced to around £75,000 per kilogram, while recombinant albumin, which makes up an estimated 96.6% of the total recombinant protein volume, must drop to about £7.50 per kilogram. Additionally, insulin and transferrin should cost approximately £750 per kilogram. These figures represent a staggering reduction - up to 99% - from current prices in the biopharmaceutical industry [3].

The Good Food Institute highlights the challenge with these ambitious targets:

"Setting a hypothetical and ambitious future benchmark production cost for cultivated meat at $10/kg, we calculated the total budget allowable for growth factors and recombinant proteins at a 10% cost contribution, equivalent to a total cost contribution of $1/kg of cultivated meat" [3].

These price reductions are not just a goal - they are a necessity if cultivated meat is to achieve widespread adoption. However, the road to scaling production brings additional hurdles.

Expected Timelines and Obstacles

The cultivated meat industry is aiming for a major production scale-up by 2030, with projected outputs ranging from 0.4 to 2.1 million metric tonnes. To meet these goals, breakthroughs in production techniques, such as synthesising growth factors in-house, will be crucial. But the path forward is far from straightforward. For example, producing recombinant albumin at the target price of £7.50 per kilogram would require output in the millions of kilograms - an amount that dwarfs the current production capabilities of most industrial enzymes. Similarly, the current global production of transferrin is just 0.2 to 0.3 metric tonnes per year, yet future demand could soar to dozens or even hundreds of metric tonnes [3].

Rajesh Krishnamurthy, CEO of Laurus Bio, captures the uncertainty surrounding these production challenges:

"Unless we have visibility into that demand, we cannot invest [in bigger bioreactors]" [8].

Another critical factor is media efficiency. If production requires more than 8–13 litres per kilogram of meat, the cost savings could be wiped out. David Block from the University of California, Davis, stresses the importance of reducing media costs:

"To make cultivated meat commercially viable, that number [media cost] is probably going to have to be $1 per litre or less - so orders of magnitude lower" [8].

These challenges highlight the intricate balance needed between scaling production, reducing costs, and maintaining efficiency to bring cultivated meat to the masses.

sbb-itb-c323ed3

Dr. Peter Stogios: Low-cost growth factors for serum-free media

Conclusion

Cutting down the costs of growth factors is crucial for making cultivated meat a viable alternative to conventional meat. Growth factors are still one of the most expensive components in cultivated meat production, often accounting for up to 99% of the cost of cell culture media [2]. Their instability compounds the issue, as frequent replenishment is required, pushing expenses even higher. To achieve even a small share of the global meat market, the production of recombinant proteins would need to scale to millions of kilograms - far beyond current industrial enzyme production capacities [3].

Fortunately, progress is being made. Innovations like in-house production have slashed costs from £146/mg to just £5.57/mg [1]. Plant-based substitutes, such as chickpea-derived albumin, have demonstrated cost reductions of up to 60% [4]. Meanwhile, chemically synthesised small molecules are emerging as another cost-cutting solution. For example, in February 2025, The Cultivated B introduced guanylhydrazone-based molecules that maintain their activity for over 13 days, a significant improvement over the rapid degradation of traditional growth factors [6].

"This breakthrough has the potential to revolutionize the scalability, consistency, and cost-effectiveness of cell-based product manufacturing, including applications in cultivated meat and cell therapy." – Dr. Hamid Noori, CEO and founder, The Cultivated B [6]

While these technological strides are promising, they need to be matched with efforts to educate consumers and scale production effectively. Clear communication about the role of recombinant proteins and alternative methods is essential for fostering consumer trust and acceptance. Transparency about how costs are being reduced will also play a key role in preparing the market for this new category of food.

As the industry works towards the ambitious goal of £7.50 per kilogram for cultivated meat, platforms like Cultivated Meat Shop are helping to bridge the gap by educating consumers about these advancements. Building trust and understanding is just as critical as refining production processes to ensure cultivated meat becomes a widely accepted and accessible option in the future.

FAQs

Why do growth factors make cultivated meat so expensive?

Growth factors are among the priciest elements in the production of cultivated meat. These specialised proteins play a vital role in promoting cell growth, but their production demands high-purity manufacturing processes, which drives up costs. At present, they make up the bulk of the expenses associated with the cell-culture media used in this process.

One major hurdle is that a significant portion of these growth factors goes unused during cultivation, leading to waste and escalating costs. To tackle this, researchers are exploring new approaches, such as developing more efficient production techniques and refining formulations. These efforts aim to reduce expenses and, ultimately, make cultivated meat more accessible and affordable.

How does producing growth factors in-house help lower the cost of cultivated meat?

Producing growth factors internally gives cultivated meat producers the chance to cut ties with costly external suppliers. Techniques such as precision fermentation, plant-based molecular farming, and cell-free expression platforms enable them to scale production effectively while creating more budget-friendly versions of these critical components.

This strategy not only slashes the cost of cultivating meat but also makes it more accessible to consumers, paving the way for a more affordable and forward-thinking food system.

What challenges need to be addressed to make cultivated meat affordable by 2030?

Reducing the cost of cultivated meat to match traditional meat by 2030 is no small feat, with several major obstacles to tackle. One of the most pressing issues is the high cost of growth factors and other proteins used in cell-culture media. These components currently drive up production expenses significantly - growth factors alone add around £2–£3 per kilogram, while other proteins can contribute a hefty £70–£100 per kilogram. To bring these costs down, the industry is turning to solutions like precision fermentation, media recycling, and protein-free formulations.

Another major challenge lies in scaling up production. Using large bioreactors - some as big as 100,000 litres - and continuous-culture systems could help cut costs by boosting output. However, achieving consistent, high-density cell growth at such a scale is both technically demanding and requires substantial capital investment. Beyond that, advancements in automation and more efficient supply chains for food-grade ingredients will be essential to streamline production.

Regulatory hurdles also complicate the path forward. In the UK and EU, navigating approval processes demands extensive safety testing and adherence to evolving food regulations, requiring significant financial and time commitments. Overcoming these scientific, engineering, and regulatory barriers will be key to making cultivated meat a cost-effective and viable alternative by the early 2030s.