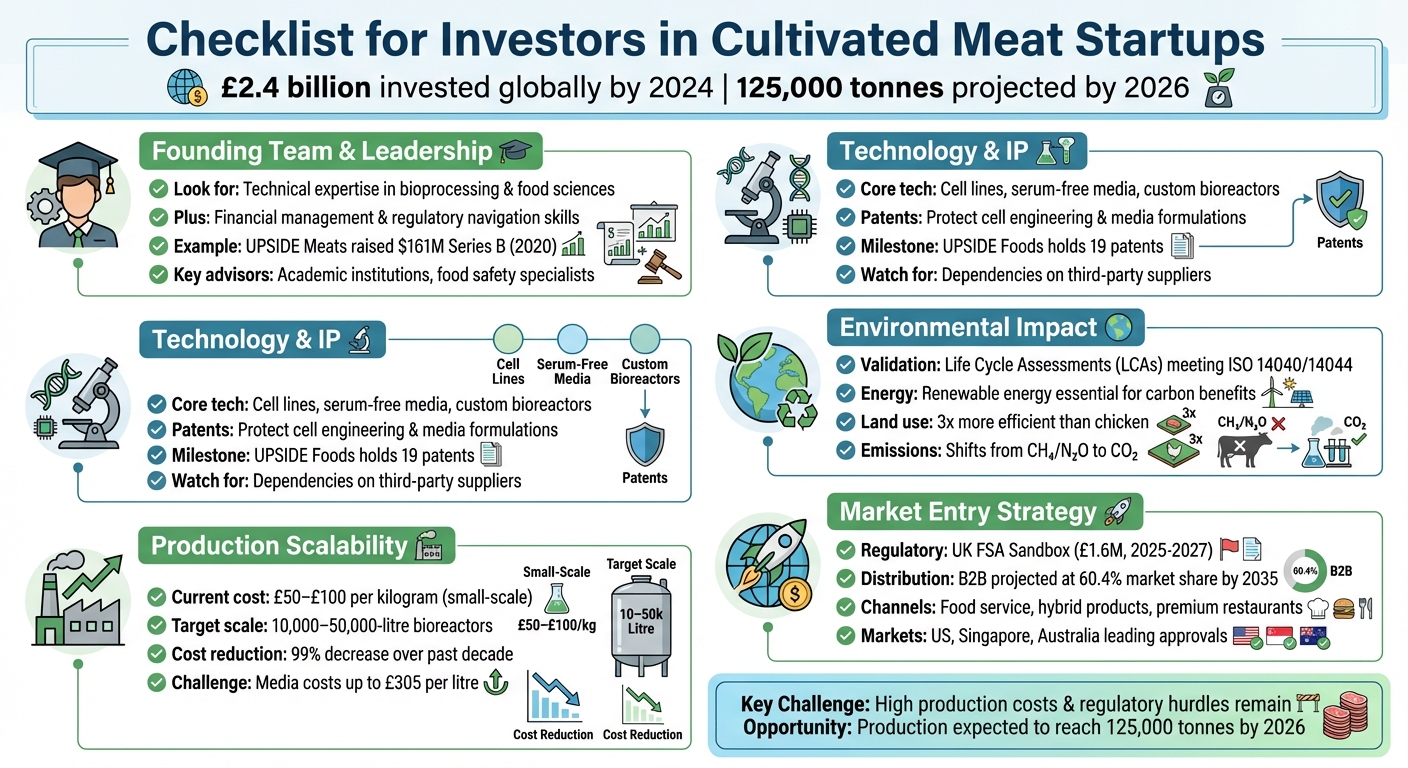

Investing in cultivated meat startups can be promising, but it requires careful evaluation. These companies aim to produce real meat from animal cells, offering faster production cycles, reduced resource use, and lower greenhouse gas emissions. With over £2.4 billion invested globally by 2024 and regulatory approvals advancing in markets like the US, Singapore, and Australia, the sector is gaining momentum. However, challenges like high production costs (£50–£100 per kilogram), regulatory hurdles, and scalability remain.

Here’s what investors should assess:

- Founding Team: Look for technical expertise in bioprocessing and food sciences, along with strong financial and regulatory management skills.

- Technology: Evaluate the startup’s use of cell lines, serum-free media, and custom bioreactors. Check patents and intellectual property for competitive advantages.

- Production Scalability: Assess plans for scaling up to industrial-level production (10,000–50,000-litre bioreactors) and cutting costs, especially in growth media.

- Environmental Claims: Verify claims through Life Cycle Assessments (LCAs) that meet ISO standards and account for energy use.

- Market Entry: Review regulatory readiness, distribution strategies (B2B or food service), and consumer education efforts.

With production expected to reach 125,000 tonnes by 2026, the industry is growing, but success depends on a startup’s ability to manage costs, scale production, and navigate regulations. This guide provides a framework to evaluate opportunities in this emerging market.

5 Key Investment Criteria for Cultivated Meat Startups

Talking Cultured Meat Economics With Jim Mellon

1. Review the Founding Team and Leadership

The success of a cultivated meat startup largely depends on the strength of its founding team. Investors should look for a combination of technical expertise and commercial skills. Founders need a solid background in fields like bioprocessing, tissue engineering, or food science - areas directly tied to growing meat from cells. But technical know-how alone won’t cut it. The team must also prove they can secure funding, manage finances, and navigate the tricky regulatory landscape required to bring their product to market [4][1].

A capable leadership team often includes scientists, food technologists, and business strategists who can transition innovations from the lab to large-scale production. It’s also worth checking if the team has access to advisors or industry experts who can provide technical insights and boost credibility. Relationships with academic institutions or consultants in bioprocessing and food safety can signal a strong commitment to filling any knowledge gaps. For example, Lever VC has developed scientific benchmarks to assess companies like TurtleTree (Singapore), Mission Barns (US), and CellX (China), using data-driven metrics to identify overly ambitious claims [7].

Good financial management is another cornerstone. Reviewing the team’s ability to raise capital and deliver on business plans is key. Take UPSIDE Meats (formerly Memphis Meats) as an example - they secured $161 million in Series B funding back in 2020, with backing from big names like Bill Gates, Richard Branson, and Kimbal Musk [10]. This achievement not only highlighted their technical progress but also their leadership’s ability to attract major investors and manage large-scale operations.

Adaptability is just as important. Since cultivated meat technology is still evolving, leadership must be willing to adjust strategies based on new scientific developments and lessons learned.

Jonathan Avesar, Lead Scientific Advisor at Lever VC, puts it this way: "We use these benchmarks to more quantitatively evaluate cultivated meat companies and identify areas where they lack progress or where certain metrics may be overly optimistic and require additional claim-vetting" [7].

Such careful evaluation helps avoid situations where lofty technology claims fail to deliver. Key areas of expertise, connections, and financial management are outlined below.

1.1 Founders' Background and Experience

Founders with experience in biotechnology, food science, or bioprocessing bring valuable expertise to the table. A track record in scaling technical operations is particularly important, as cultivated meat requires moving from small lab samples to industrial-scale production. For early-stage companies, it’s essential to confirm that founders have hit the technical milestones relevant to their current funding stage.

Jasmin Kern, Scientific Associate at Lever VC, emphasises: "Especially for very early-stage companies, where cell mass quantities are extremely low and access to analytical tools is limited, rigorous scientific diligence is essential to validate a viable investment opportunity" [7].

Experience in scaling technical ventures also indicates the ability to manage large operations, secure funding, and develop a realistic go-to-market plan. Investors will want to see projections for unit economics at scale, as venture capital typically expects high returns [8].

1.2 Advisors and Industry Connections

Advisors can fill in gaps by providing technical validation and regulatory expertise that startups might lack internally. Investors should confirm that the company has active ties with academic institutions, industry consultants, or food safety specialists.

Strategic partnerships also play a vital role. For instance, Silicon Valley Bank has lent its expertise in debt financing to alternative protein companies, while ARCO/Murray has collaborated with startups to set up production facilities for cultivated meat [6]. These connections suggest the company is gearing up for commercial-scale operations.

1.3 Financial Management and Business Strategy

Assessing the team’s ability to raise funds and manage budgets is critical, especially as they move from R&D to commercialisation. Effective financial management includes plans for scaling production and cutting costs. As operations expand, handling non-dilutive financing for technology and equipment becomes increasingly important [6][4].

A solid business strategy should address key areas like unit economics, market entry plans, and a clear value proposition. Additionally, the team should demonstrate readiness for investment by managing practical aspects such as intellectual property registration, data privacy policies, and securing specialised insurance (e.g., product liability and employer’s liability) [9]. These operational details reflect a team that’s prepared to turn its vision into reality.

2. Examine Technology and Intellectual Property

When evaluating a startup, understanding its technical foundation and intellectual property (IP) is critical. These factors often reveal whether the company has a genuine edge or is simply following standard industry practices. Investors need to dive into the startup's technology, development progress, and IP strategy to gauge its potential as the market evolves.

2.1 Core Technology and Methods

A key factor that sets startups apart is their choice of starter cells. Companies typically work with skeletal muscle stem cells (myosatellite cells), fibroblasts, mesenchymal stem cells (MSCs), or induced pluripotent stem cells (iPSCs). Each type offers unique benefits, particularly in terms of scalability and achieving the right texture for the final product [3][11]. To scale production effectively, many startups use genetic modification techniques to create immortalised cell lines, which allow for continuously renewable cell banks [11][12].

Another area of focus is the development of serum-free media formulations. Moving away from fetal bovine serum (FBS) is a major step forward in reducing costs and ensuring consistent production. Startups that develop proprietary media recipes gain a competitive edge [3]. Additionally, some companies are designing custom bioreactors rather than relying on modified off-the-shelf equipment. These bespoke bioreactors often incorporate patented features, such as continuous bioprocessing systems, to optimise efficiency [3].

For investors, it's also essential to confirm that the startup has secured the quality and traceability of its starter cells. This becomes especially important when cells are sourced from live animal biopsies, as it ensures the company holds the necessary commercial rights [3].

Once the core technology is understood, the next step is to evaluate the company's development timeline and research pipeline.

2.2 Development Progress and Research Pipeline

Most current efforts in the cultivated meat space focus on producing ground meat products like burgers and nuggets, as well as hybrid options that combine cultivated cells with plant-based ingredients to keep costs manageable [1]. Looking further ahead, startups are aiming to produce structured products - such as steaks and fillets - with intricate muscle and fat compositions by 2025–2030 [1].

Take UPSIDE Foods, for example. The company operates the EPIC (Engineering, Production, and Innovation Centre) in California, where it produces cultivated chicken. As of early 2026, UPSIDE Foods holds 19 patents, including one from 2014 for myogenic differentiation and another from 2018 for increasing cell density. The company is also working on a larger production facility designed to produce over 10 million pounds (around 4.5 million kilograms) of meat annually [13]. These milestones are crucial for achieving the scale needed for commercial success.

In the UK, the Food Standards Agency has introduced a £1.6 million regulatory sandbox that runs from February 2025 to February 2027. This initiative, involving companies like Mosa Meat, BlueNalu, and Hoxton Farms, aims to provide additional technical guidance on cell identity and toxicology by 2026 [5].

Investors should closely examine whether a startup's timeline aligns with realistic technical goals. While production costs have dropped by over 99% in the last decade, small-scale production still costs between £50–100 per kilogram [1]. Growth media costs remain a significant hurdle, with some components like FGF2 costing millions per gramme. Overcoming these challenges is essential for achieving commercial viability [1].

2.3 Patent Portfolio and IP Protection

A strong patent portfolio is a critical asset for startups, solidifying their market position alongside their technology and R&D efforts.

Patents often focus on innovations such as engineering cell lines to thrive in serum-free media or enabling suspension growth [3]. Nearly half of cultivated meat companies are exploring genetic engineering for both research and commercial purposes, with several patents already filed to protect these approaches [3]. By 2024, industry organisations were tracking approximately 75 available cell lines [3].

It's also vital for investors to assess whether a startup depends on third-party B2B providers for key components like growth factors or cell lines. Such dependencies could lead to royalty disputes or supply chain issues down the line [3]. Regulatory data protection provides another layer of IP security. In the UK, for instance, companies can request that the confidential data supporting their novel food applications remain exclusive for five years after authorisation [5]. Protecting technical dossiers during regulatory filings can offer a significant advantage through data exclusivity [5].

3. Check Production Scalability and Manufacturing Plans

After evaluating the startup's technological groundwork and intellectual property strategy, the next step is to assess whether their production plans can effectively transition lab successes into large-scale commercial outputs. Scaling up from small-scale production to ton-level manufacturing is a critical hurdle. Investors should take a close look at the startup's roadmap for increasing capacity, cutting costs, and securing dependable suppliers. This stage also involves a deep dive into the startup's production facilities, equipment, and automation strategies.

3.1 Production Facilities and Equipment

Currently, most cultivated meat companies operate on a relatively small scale, but the industry's goal is to reach a total output of around 125,000 tonnes by the end of 2026 [2]. To achieve this, startups must scale up from bench-scale production to pilot operations (100–1,000 litres) and eventually to industrial-scale manufacturing (10,000–50,000-litre bioreactors) [2][3].

Stirred-tank bioreactors are the go-to choice for most in the industry. However, some companies are experimenting with alternatives like air-lift or hollow-fibre reactors to improve efficiency for specific cell types [2]. For instance, by the end of 2024, Believer Meats had achieved bioreactor volumes of 15,000 litres at its facilities, marking a leap from pilot to industrial-scale production [3].

Another way to lower costs is by transitioning to food-grade materials. Investors should ensure the startup has a clear plan for adopting food-grade infrastructure, as this is a key step towards making cultivated meat competitively priced with conventional meat.

Automation also plays a vital role in scaling up. Startups investing in automated systems for tasks like cell separation, harvesting, and monitoring can significantly reduce labour costs while ensuring consistency [2].

Once production facilities are in place, the focus shifts to strategies aimed at driving down production costs.

3.2 Cost Reduction Plans

The cost of producing cultivated meat has dropped dramatically, from approximately £250,000 per kilogramme in 2013 to £50–100 today [1]. Despite this progress, further reductions are needed to match the price of conventional meat, with cell culture media being the largest cost driver.

Media expenses remain a major challenge. Some formulations can cost as much as £305 per litre, with growth factors like FGF2 priced at millions per gramme [1]. Startups need to present a viable plan to reduce media costs to under £0.80 per litre. One promising approach is replacing costly amino-acid media with plant protein hydrolysates [15].

"Suitable formulations of amino acids and protein growth factors are not currently produced at scales consistent with food production, and their projected costs at scale are likewise high." – David Humbird, Author of Scale-Up Economics for Cultivated Meat [15]

GOOD Meat made strides in early 2023 when it received regulatory approval from the Singapore Food Agency to use serum-free media for its cultivated chicken production. This move eliminated the need for expensive animal-derived components [3]. Investors should check whether a startup has adopted serum-free media or has a realistic timeline for doing so.

Other cost-saving strategies include media recycling, which reduces recurring expenses [2]. Additionally, switching to fed-batch or continuous production methods can enhance efficiency compared to traditional batch processing [2].

3.3 Supply Chain Relationships

A reliable supply chain is critical for sustained production. Startups need consistent access to bioreactors, growth factors, and food-grade materials, though long equipment lead times and supplier availability remain significant hurdles [2].

Investors should investigate whether the startup has formed partnerships with established food or animal feed manufacturers to source essential inputs like amino acids and glucose at scale [3]. These partnerships are crucial for accessing inputs at food-grade prices, which are significantly lower than pharmaceutical-grade costs.

Strategic investments from established industry players can also signal supply chain maturity. For example, Cargill's investment in Aleph Farms not only provided financial support but also opened up access to established distribution networks [14]. Similarly, Co-development Manufacturing Organisations (CDMOs) offer startups shared manufacturing capacity, helping them avoid the high capital costs of building large facilities independently [3].

Finally, it's essential to evaluate whether the startup has secured timely access to critical equipment like bioreactors and growth factors. Delays in equipment delivery or weak supplier relationships can derail production timelines and inflate costs. A well-documented supply chain strategy is a strong indicator of operational readiness.

sbb-itb-c323ed3

4. Assess Environmental Impact and Brand Positioning

After evaluating a startup's production capabilities and supply chain, the next crucial step is understanding how they communicate their environmental impact and position themselves in the market. For cultivated meat startups, sustainability is often at the heart of their branding. However, for these claims to hold weight, they need to be supported by solid data. This section delves into the environmental claims and branding strategies that shape a startup's identity.

4.1 Environmental Data and Claims

Many startups rely on Life Cycle Assessments (LCAs) to substantiate their environmental claims. These assessments measure factors like greenhouse gas emissions, water use, and land requirements. It's important for investors to differentiate between two types of LCAs: retrospective LCAs, which analyse existing systems, and prospective LCAs, which model future commercial operations [16]. Since most cultivated meat companies are in their early stages, prospective LCAs often provide a clearer picture of long-term environmental performance.

Energy usage is a key factor. Cultivated meat production is energy-intensive, meaning its carbon footprint heavily depends on the energy sources used. Research indicates that when powered by renewable energy, cultivated meat can achieve a smaller carbon footprint than conventional poultry or pork. Without renewables, however, the environmental benefits become less definitive [17].

"While CM production and its upstream supply chain are energy-intensive, using renewable energy can ensure that it is a sustainable alternative to all conventional meats." – The International Journal of Life Cycle Assessment [17]

A significant shift happens in greenhouse gas emissions. Unlike conventional livestock, which produces methane (CH₄) and nitrous oxide (N₂O), cultivated meat shifts the focus to carbon dioxide (CO₂) from industrial energy use. This is notable because animal agriculture is responsible for 16.5% to 19.4% of global greenhouse gas emissions, with ruminants alone accounting for 27% of global methane emissions [17].

Land use is another area where cultivated meat shows promise. Livestock farming currently occupies 83% of global agricultural land [17]. Cultivated meat is about three times more efficient than chicken - the most efficient traditional meat - at converting crops into meat. This efficiency could free up vast amounts of land, which could then be used for carbon sequestration or biodiversity restoration.

Investors should ensure that a startup's LCA complies with ISO 14040/14044 standards and has undergone critical review by independent experts [16]. It's also worth confirming whether the LCA aligns with the 2025 international guidelines for cultivated meat, which address data gaps in areas like culture media and production-scale activities [16]. Notably, three out of four recent major studies have shown that cultivated meat offers lower global warming potential and reduced water use compared to beef, despite its high energy demands [16].

4.2 Brand Strategy and Consumer Messaging

A startup's brand narrative is as important as its technical metrics. Effective messaging often emphasises humane and sustainable production, giving consumers the chance to enjoy real meat without the ethical concerns of slaughter [13][18]. Startups frequently use catchy slogans like "meat reimagined" or "no farm, no fowl" to appeal to meat lovers who are uneasy about factory farming [13]. Eitan Fischer, CEO of Mission Barns, highlights this shift:

"Throughout history, the only way to eat meat has been to take the life of an animal. Now, for the first time, we can cultivate meat without harm." [18]

Transparency plays a big role in consumer trust. Companies like UPSIDE Foods openly share details about their production processes, including the "cell feed" - a mix of sugars, amino acids, and vitamins used to grow cells. This openness helps demystify the science behind cultivated meat, particularly for sceptical consumers [13].

Food safety is another key selling point. Cultivated meat is produced in sterile, controlled environments, eliminating the need for antibiotics and significantly reducing the risk of foodborne illnesses like E. coli or Salmonella [13][18]. As Amy Chen, COO of UPSIDE Foods, puts it:

"It tastes like chicken because it is chicken." [18]

Investors should also consider how startups balance their environmental claims with their energy requirements. While cultivated meat uses less land and water, its high energy consumption could undermine its greenhouse gas reductions without renewable energy. Labelling is another factor to watch, especially in the UK, where products involving genetic modification may require a "genetically modified" label. This could influence consumer perception. Several startups, such as BlueNalu, Gourmey, and Hoxton Farms, are participating in the UK Food Standards Agency's Regulatory Sandbox programme. This initiative, launched in February 2025 with a £1.6 million budget, helps refine safety standards and labelling requirements [5].

4.3 Market Trends and Consumer Demand

The cultivated meat industry is on track for significant growth, with production expected to reach 125,000 tonnes by 2026 and potentially between 400,000 and 2.1 million tonnes by 2030 [2]. This growth aligns with rising consumer interest in ethical and sustainable food options.

One emerging trend is the development of hybrid products that combine cultivated cells with plant-based ingredients. This approach helps manage costs and meet early consumer demand, allowing startups to enter the market more quickly while perfecting fully cultivated products [16].

Consumers are increasingly interested in nutritional information. Startups that clearly communicate details like protein quality, dry matter content, and amino acid profiles may gain a competitive edge [14][16]. Regulatory engagement is another growing trend. By participating in initiatives like the UK FSA Sandbox, startups not only speed up their market entry but also demonstrate a commitment to compliance and safety [5].

Investors should also evaluate how well a startup communicates the performance of its products, including nutritional value, shelf-life, and taste. Early reviews of cultivated chicken have noted favourable textures, though some products have been criticised for lacking fat or having a "gel-like" consistency [18].

Cultivated Meat Shop offers educational resources, product previews, and waitlist sign-ups, helping to build consumer interest and trust in this emerging market.

5. Review Market Entry and Launch Strategy

Once a company has established its environmental credentials and brand identity, the next challenge is transitioning from lab innovation to a market-ready product. This involves navigating regulatory hurdles, building distribution networks, and ensuring consumers are well-informed. Let’s dive into the steps cultivated meat startups are taking to bring their concepts to life.

5.1 Regulatory Status and Approvals

As of late 2025, no cultivated meat products have been approved for sale in the UK or the European Union [20]. In Great Britain, these products fall under the legal category of "products of animal origin" but do not meet the strict definition of "meat" [19]. Companies looking to gain approval must apply via the Regulated Product Application Service under Novel Food or GMO regulations [5].

In February 2025, the UK Food Standards Agency (FSA) and Food Standards Scotland (FSS) launched the Cell-Cultivated Products Sandbox Programme. Backed by a £1.6 million grant from the Department for Science, Innovation and Technology, this initiative runs until February 2027 and supports seven startups, including BlueNalu, Gourmey, and Hoxton Farms. The programme offers tailored guidance and business support to help companies prepare safety dossiers [5].

"The Sandbox programme is allowing us to fast-track regulatory knowledge to reduce barriers for emerging food technologies without compromising on safety standards."

– Dr. Thomas Vincent, Deputy Director of Innovation, Food Standards Agency [19]

Participation in this programme can be a key advantage for startups, as it provides direct access to pre- and post-submission support. Companies must also demonstrate batch consistency across at least five representative samples and ensure their products match the nutritional profile of conventional meat, including essential vitamins, minerals, and protein quality [20]. Additional technical guidance from the FSA and FSS on areas like cell identity, toxicology, and growth media is expected in 2026 to further assist startups [19].

Meanwhile, in Europe, Dr. Nikolaus Kriz, the new director of the European Food Safety Authority (EFSA), has committed to speeding up novel food assessments by introducing faster timelines as a priority goal [20].

Regulatory approval from bodies like the FSA is often viewed as more critical than marketing claims, such as "slaughter-free" or "carbon-neutral" [21]. Clearing these regulatory hurdles sets the stage for a strong market entry.

5.2 Launch Plans and Distribution Channels

Most startups are opting for a B2B model, supplying cultivated meat as ingredients to established food processors and restaurant chains. By 2035, the B2B segment is projected to account for 60.4% of the cultivated meat market [25]. This approach allows startups to bypass the slower growth of direct-to-consumer retail and instead focus on integrating their products into hybrid offerings.

Food service channels, including restaurants, hotels, and fast-food outlets, are another key focus. These venues offer controlled environments where chefs can prepare meals professionally, helping to shape positive consumer perceptions. For instance, Wildtype, a San Francisco-based startup, began serving its cultivated salmon at select high-end restaurants in 2023, specifically targeting sushi and sashimi dishes [24].

Hybrid products are also gaining traction. In May 2024, GOOD Meat, a division of Eat Just, introduced "GOOD Meat 3" in Singapore. This frozen product contains 3% cultivated chicken, offering the taste and texture of traditional chicken at a lower cost. It was launched in the retail sector through Huber's Butchery [23][25].

The UK has also made strides in niche markets, approving cultivated chicken for use in pet food [22].

For investors, it’s crucial to check whether a startup has secured partnerships with food service distributors or premium culinary brands. These collaborations not only provide scale but also validate the product before a broader retail launch.

| Distribution Channel | Projected 2035 Market Share | Target Consumer |

|---|---|---|

| Business-to-Business (B2B) | 60.4% | Food processors, restaurant chains, ingredient manufacturers |

| Food Service | Leading End-Use Segment | Restaurant diners, hotel guests, eco-conscious consumers |

| Retail | Secondary/Growth Segment | Supermarket shoppers, online grocery buyers |

| Pet Food | Emerging Niche | Environmentally conscious pet owners |

Data sources: [25] for B2B, Food Service, and Retail; [22][24] for Pet Food.

A strong distribution network is only part of the equation. Consumer education is equally crucial, as we’ll explore next.

5.3 Consumer Education and Early Interest

Educating consumers about cultivated meat is a critical step in building trust and interest. Startups can gauge market demand early by leveraging crowdfunding campaigns, focus groups, surveys, or letters of intent [8][26]. These activities not only validate consumer interest but also attract potential investors.

Educational initiatives play a pivotal role in breaking down misconceptions. For instance, the Good Food Institute offers a free online course on the science behind plant-based and cultivated meat, which has drawn over 4,000 participants [8][26]. By providing accessible and transparent information, startups can counter scepticism and build credibility.

Ethical branding is another effective strategy. Participating in initiatives like PETA’s "Eat Without Experiments" programme, which opposes animal testing unless legally required, appeals to ethically conscious and vegan-leaning consumers [24][27]. Being open about production methods and sourcing further strengthens trust among those prioritising food safety and sustainability.

Test marketing in specific regions can also provide valuable insights. Singapore, for example, has become a popular testing ground thanks to government-backed resources like FoodInnovate, which supports R&D and international commercialisation [26]. Limited product launches in select restaurants or retail outlets allow startups to fine-tune their offerings based on consumer feedback.

Platforms like Cultivated Meat Shop are also helping to generate early interest by offering educational resources, product previews, and waitlist opportunities. These efforts are preparing consumers in the UK and Europe for the arrival of cultivated meat, ensuring a smoother transition to commercial availability.

For investors, it’s worth evaluating whether a startup has a clear go-to-market strategy. Whether through B2B partnerships, food service channels, or direct-to-consumer approaches, a strong narrative and early traction - via surveys, focus groups, or pre-sales - can make all the difference [8][26].

6. Conclusion

Investing in cultivated meat startups requires a thorough assessment across several critical areas. Key factors include the founding team's expertise, technical know-how, and financial discipline. A robust patent portfolio and well-protected intellectual property are essential for maintaining a competitive edge, while scalable production strategies must aim to bring costs closer to the current small-scale estimates of £50–100 per kilogramme [1].

Claims about environmental benefits need proper validation through reliable Life Cycle Assessments (LCAs). According to the Environmental Defense Fund, investors should focus on companies that "work with partners such as academics and non-governmental organisations (NGOs) to conduct LCAs and systems analyses" [28]. Additionally, strong branding and consumer education efforts indicate a company’s readiness to capture market interest.

Regulatory preparedness is another cornerstone of success. Participation in initiatives like the UK's Cell-Cultivated Products Sandbox, supported by £1.6 million in government funding, demonstrates a startup's commitment to navigating regulatory hurdles [5]. Equally important are distribution strategies, whether through B2B collaborations, food service partnerships, or hybrid product rollouts, as these provide a clear path from lab innovation to market availability. Together, regulatory and distribution achievements lay the groundwork for scaling operations effectively.

This multi-faceted approach aligns with earlier discussions on team strength, innovation, and market strategy. With over $2 billion already invested globally and production costs reduced by an astonishing 99% over the past decade, the cultivated meat industry is steadily transitioning from concept to commercialisation [1].

"You'll need to be highly profitable when you are at scale." – Good Food Institute [8]

FAQs

What are the main challenges in scaling cultivated meat production?

Scaling up the production of cultivated meat comes with its fair share of challenges. One of the most pressing issues is the steep production cost, currently hovering around £50 per kilogram. This price point makes it hard for cultivated meat to compete with traditional meat options.

On top of that, there are technological roadblocks to address. These include advancements needed in bioprocessing methods, bioreactor designs, and creating efficient supply chains. Together, these factors make scaling up a highly complex and resource-heavy process.

Tackling these obstacles will demand fresh ideas, substantial investment, and collaboration across the industry. Only then can cultivated meat become a practical and appealing alternative to conventional meat.

How can investors assess the environmental claims of cultivated meat startups?

Investors aiming to assess the environmental claims of cultivated meat startups should focus on life cycle assessments (LCAs). These evaluations provide a detailed look at factors like greenhouse gas emissions, energy consumption, and resource use throughout the production process. For trustworthy insights, prioritise LCAs conducted by independent experts and aligned with internationally recognised standards.

There are also industry tools and guidelines designed to standardise how environmental impacts are measured. These make it easier to compare data across different companies. In the UK, regulatory bodies such as the Food Standards Agency are developing frameworks to evaluate both the safety and environmental aspects of cultivated meat, offering additional benchmarks for assessing credibility.

By leaning on transparent, independently verified assessments and adhering to established standards, investors can make better-informed decisions about the environmental claims of startups within this forward-thinking industry.

What should investors consider when assessing a cultivated meat startup's regulatory readiness?

When assessing a cultivated meat startup's preparedness for regulatory approval, there are a few essential aspects investors should keep in mind to gauge their potential for a smooth market launch. First, it's important to verify if the company is actively working to secure approvals from the appropriate regulatory agencies, like the Food Standards Agency (FSA) in the UK. Meeting novel food regulations and demonstrating that their production process effectively addresses chemical and biological risks are strong signs of readiness.

It's also worth examining whether the startup has a well-defined plan for navigating the regulatory environment. This includes actively engaging with approval processes, maintaining open lines of communication with regulators, and consistently meeting standards for safety, labelling, and transparency. Taking a proactive stance on compliance not only helps avoid unnecessary delays but also strengthens consumer confidence - an essential ingredient for long-term success in the cultivated meat industry.